- The company focuses its strategy during the year on minimising the impact of Covid-19, to achieve a sound liquidity position of €1.360 million

- Gross asset value comes to €19.38 billion in the period, with a predominance of liquid assets, accounting for more than 80% of the total.

- Despite the impact of the Covid-19 pandemic on its investees, CriteriaCaixa received €625 million in dividend income during the last year.

- CriteriaCaixa pays €390 million in dividends to its sole shareholder, ”la Caixa” Banking Foundation, which in 2020 redoubled its efforts to alleviate the effects of the coronavirus on the most vulnerable segments of society.

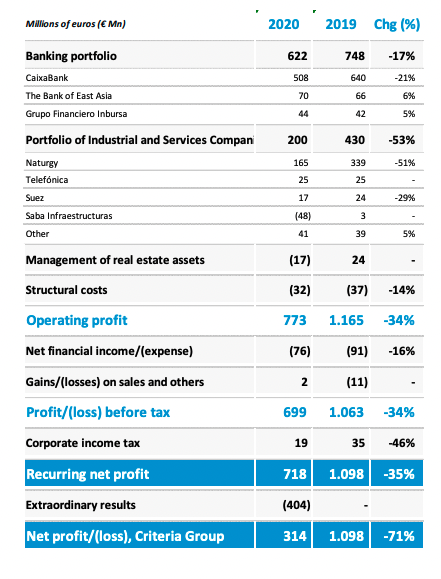

Barcelona, 23 March 2021 – CriteriaCaixa, the company that manages the business assets of ”la Caixa” Banking Foundation, reports consolidated net profit of €314 million in 2020, down 71% on the previous year.

This decrease is due to the impact of the Covid-19 pandemic on the results of CriteriaCaixa’s main investees, on the one hand, which has led CriteriaCaixa´s like-for-like net profit to €718 million (35% lower as of 2019). On the other hand, to the impact of extraordinary results -for a total amount of -404 million euros- as a consequence of the attribution of the impairment that Naturgy recorded in its generation assets and the adjustment recorded by CriteriaCaixa of the PPA (Purchase Price Allocation) of CaixaBank.

In order to minimize the impact of the Covid-19 pandemic, CriteriaCaixa focused its strategy in 2020 on preserving liquidity, moderating the pace of new investments, negotiating new liquidity facilities and actively managing short- and medium-term debt maturities.

At year-end 2020, the gross value of CriteriaCaixa’s assets was €19.38 billion, with 75.9% in listed equities, 13.6% in real estate assets, 4.7% in non-listed equities, 1% in fixed income and other, and 4.8% in cash and cash equivalents. Listed assets (equities and fixed income) and cash and cash equivalents represent more than 80% of the total.

Despite the consequences that the crisis has had on CriteriaCaixa’s main investees, it is worth noting that in 2020 the company received €625 million in dividend income.

CriteriaCaixa delivered €390 million in dividends to its sole shareholder, ”la Caixa” Banking Foundation, which in 2020 redoubled its efforts to alleviate the effects of the coronavirus on the most vulnerable segments of society, such as children at risk of exclusion, the elderly and patients with advanced diseases. In 2020, the Foundation invested a total of €502 million, distributed between social programmes (€292 million), culture and science (€91 million), research and health (€66 million) and education and grants (€53 million).

Business results

Resultsfrom the banking portfolio, comprising CaixaBank, The Bank of East Asia (BEA) and Grupo Financiero Inbursa (GFI), amounted to €622 million in 2020, down 17% on the previous year. CriteriaCaixa recorded in this financial year as an extraordinary result the impact on the PPA of CaixaBank of the sale of the 29% of Comercia Payments and the value adjustment of the stake in Erste Bank. Both transactions had an impact on CriteriaCaixa’s accounts of -€151 million.

Meanwhile, results from the industrial and services portfolio mainly includes the stakes in Naturgy and Saba, as well as the dividends received from Suez and Telefónica. This portfolio reached a result of €200 million euros, 53% less than in 2019, due to the impact of the pandemic both in the activity of the energy company, with a reduction of the ordinary result of 51%, and in the car park company, with an attributable result of -48 million euros. Additionally, the review of the valuation of certain assets carried out by Naturgy had an extraordinary negative impact of €253 million on CriteriaCaixa’s accounts.

Real estate business, managed by Inmo CriteriaCaixa and comprising a portfolio worth €2.63

billion, generated an attributable loss of -€17 million, following the recognition of impairment

losses of €27 million on the portfolio as a consequence of the impact that Covid-19 has had on

the valuation of certain assets, mainly of a residential nature.

Investment diversification

CriteriaCaixa has been diversifying its portfolio since 2018 by adding new names, geographies and sectors of the economy, prioritising listed companies in OECD countries with growth potential and an adequate dividend yield. The market value of this portfolio reached €3.69 billion at the end of 2020, including key stakes in Cellnex, Suez and Telefónica.

In 2020, a net investment of €534 million euros was made to expand the diversification portfolio (€889 million in 2019). This slowdown in the investment rhythm has been carried out in order to preserve adequate levels of liquidity to cope with possible adversities arising from the crisis.

Enhanced financial profile

Gross debt at CriteriaCaixa amounted to €5.12 billion in 2020, slightly above the level reported a year earlier. Net debt, however, fell by 4.2% to €4.19 billion euros. The company focused its efforts during the year on active debt management to increase liquidity levels, improve financial terms and conditions and lengthen maturities.

In this way, an issue of senior bonds with a 7-year maturity for an amount of 600 million euros was carried out in October, in order to prepay bilateral loans with shorter maturities and higher cost and enhance its liquidity position.

Following these steps, the company also had a solid available liquidity position of €1.36 billion at the end of 2020, counting both cash and cash equivalents (€935 million) and undrawn credit facilities (€425 million).

The rating agencies upheld CriteriaCaixa’s credit rating in 2020: BBB+ by Fitch Ratings (with a

negative outlook) and Baa2 by Moody’s (with a stable outlook).

APPENDIX

CriteriaCaixa’s 2020 consolidated income statement for management purposes: