- The gross asset value of CriteriaCaixa grows by 3.3% to reach €24.6 billion at year-end.

- Net asset value comes to €19.7 billion, 8.7% up on the previous year.

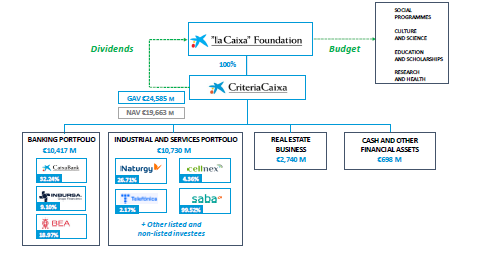

- CriteriaCaixa distributed €375 million to its sole shareholder, ”la Caixa” Foundation, which continued to invest in the most vulnerable segments of society during 2022.

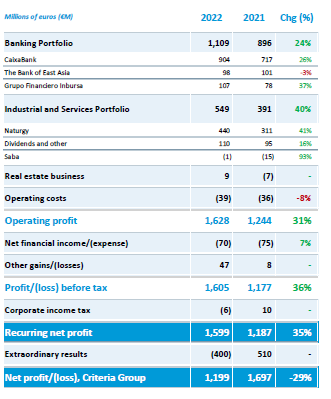

Barcelona, 13 March 2023. CriteriaCaixa, the company that manages the business assets of ”la Caixa” Foundation, posted a recurring net profit of €1,599 million in 2022, up 35% on 2021. Instead, the consolidated net profit rose to €1,199 million, down 29% on the previous year, as a result, mainly, of the extraordinary positive results recorded in 2021 after the merger between CaixaBank and Bankia.

At year-end 2022, CriteriaCaixa’s gross asset value (GAV) totalled €24.6 billion, 3.3% more than in 2021. Of this total, 83% related to listed equities and 11% to the real estate business. This breakdown demonstrates the high liquidity of the portfolio, given that listed assets and cash and equivalents account for 85% of the total.

CriteriaCaixa’s net asset value (NAV) stood at €19.7 billion, 8.7% more than the previous year. The favourable performance was largely down to the improvement in CaixaBank’s share price, which gained 52.1% in value in 2022. Likewise, the strength of operating cash flow stands out, with a significant increase in dividends received during the year.

Of the €834 million total dividends received in 2022 (vs €525 million in 2021), €354 million was received from CaixaBank, €311 million from Naturgy and €62 million from The Bank of East Asia, among other investees.

CriteriaCaixa distributed €375 million to its sole shareholder, ”la Caixa” Foundation, which continued investing in 2022 to support the most vulnerable segments of society, such as children at risk of exclusion, the elderly and patients with advanced diseases. In 2022, the Foundation invested a total of €508 million in social programmes (56.9%), culture and science (22.1%), research and health (10.6%), and education and scholarships (10.4%). For 2023, ”la Caixa” Foundation has recently announced an increase in its budget —the largest in its history— bringing it to €538 million.

Business earnings

Recurring profit attributable to the banking portfolio amounted to €1.11 billion in 2022, up €213 million (+24%) on the end of the previous year. This improvement was largely a result of the strong performance of CaixaBank and Grupo Financiero Inbursa (GFI), which contributed €904 million and €107 million, respectively, to Criteria’s earnings.

Earnings from the industrial and services portfolio —which includes attributable earnings from the stakes held in Naturgy and Saba Infraestructuras, among others, as well as dividends from the rest of the portfolio— came to €549 million, 40% more than in 2021.

Naturgy’s net profit attributable to Criteria in 2022 amounted to €440 million, up 41% on the previous year. CriteriaCaixa also received €29 million dividends from Telefónica in 2022. Further highlights included the dividends received from Criteria’s stakes in the diversification portfolio, which amounted to €89 million (€73 million in 2021).

Management of the portfolio

CriteriaCaixa’s strategic portfolio consists of its stakes in CaixaBank (32.24%), Naturgy (26.71%), The Bank of East Asia (18.97%), Grupo Financiero Inbursa (9.10%), Cellnex (4.36%) and Telefónica (2.17%). Their market value in 2022 came to €18.1 billion euros, showing a positive change of value of 9.2%. Investments worth €258 million were also made in this portfolio during the year, of which €202 million went into Telefónica and €56 million into Cellnex.

CriteriaCaixa holds a diversification portfolio with various non-controlling interests in listed companies, prioritising companies from OECD countries. This portfolio now comprises more than 80 companies from 15 different countries, the vast majority of which are large companies, all leaders in their respective sectors.

A net investment of €249 million was made in 2022 to expand the diversification portfolio. Regarding divestments, in January 2022, following the takeover bid launched by Veolia for 100% of Suez in 2020, CriteriaCaixa sold its 5.8% stake for a total amount of €737 million.

The market value of this portfolio at year-end amounted to €2.22 billion, distributed across the following sectors: Consumer (29%), Pharma/Health (18%), Automotive & Components (12%), Telecoms & Technology (11%), Materials (9%), Infrastructure (7%), Equipments (5%) and Others (9%).

CriteriaCaixa’s real estate portfolio was worth €2.74 billion in 2022 and new investments worth €366 million were added to the portfolio during the period. Highlights here include the acquisition of the office building located at Paseo de la Castellana 51 in Madrid for €238.5 million.

As part of the investment process, CriteriaCaixa also looks at ESG aspects (Environmental, Social and Governance), seeking companies with robust sustainability policies included on recognised international sustainability indices.

Financial profile

At the end of 2022, Criteria Group’s gross debt totalled €4.92 billion, compared to €5.71 billion at 31 December 2021, showing a reduction of 13.8%.

Throughout the year, CriteriaCaixa continued to actively manage its borrowings in order to gain in flexibility and extend the maturities of both its debt and credit facilities. Highlights here included the repayment on maturity of a senior bond worth €1 billion (of which, €26 million were treasury stock).

CriteriaCaixa strengthens its financial position by ensuring persistently comfortable levels of liquidity —around €1 billion—, which will enable it to meet its maturities throughout 2023. The average cost of debt remains at 1.4%, in line with the previous year.

The rating agencies upheld CriteriaCaixa’s credit rating in 2022: BBB+ by Fitch Ratings (with a stable outlook) and Baa2 by Moody’s (with a stable outlook).

APPENDICES

CriteriaCaixa’s 2022 consolidated statement of profit or loss:

Group structure at year-end 2022: