- Net asset value (NAV) increased to €22,095 million (+12% vs. 2022).

- Gross asset value (GAV) came to €26,528 million (+8% vs. 2022), with a highly liquid portfolio.

- CriteriaCaixa received €1,114 million in dividends from its investees (+34% vs 2022).

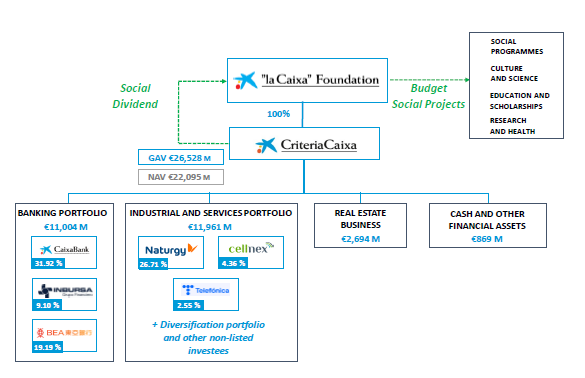

- In 2023, the holding company distributed €400 million to “la Caixa” Foundation, which invested €537 million in social action in the year and announced a record budget of €600 million for social investment in 2024.

- Isidro Fainé, Chairman of CriteriaCaixa and “la Caixa” Foundation, highlighted the strength of the company’s results: “The strong performance of CriteriaCaixa’s main investees has boosted dividends. This will give “la Caixa” Foundation a budget of €600 million for social action in 2024, the largest in its history”.

- The Board of Directors of CriteriaCaixa has asked the new CEO, Ángel Simón, to draw up a Strategic Plan for 2025-2030 to lay the foundations for this new phase, aiming to drive the creation of long-term value and maintain and increase the Foundation’s assets, so as to bolster its social work.

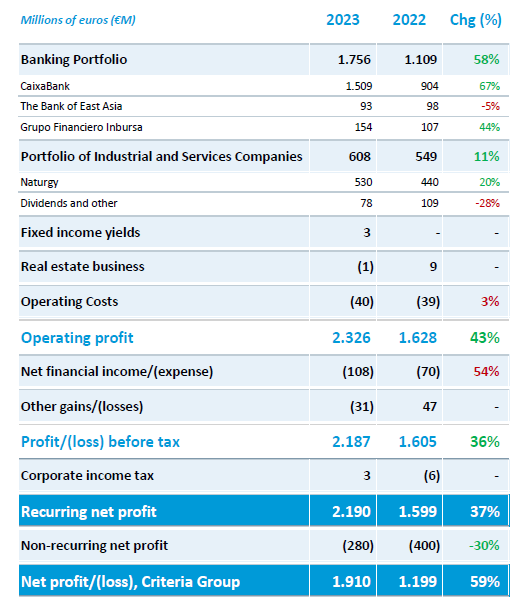

Barcelona, 8 March 2024. CriteriaCaixa, the company managing “la Caixa” Foundation’s business assets, posted consolidated net profit of €1,910 million in 2023, 59% higher than in 2022. Recurring net profit was €2,190 million, an increase of 37% compared to 2022.

Gross asset value (GAV) amounted to €26,528 million at 31 December 2023, 8% up on 2022. Of this, 84% corresponds to listed equities (including banking, industrial and services) and 10% to real estate. The remaining 6% corresponds to non-listed equities, cash and cash equivalents, fixed income and others. This demonstrates the extremely liquid nature of the portfolio, with listed assets and cash and equivalents accounting for 86% of the total.

Net asset value (NAV) increased by 12.4% in 2023, to a record 22,095 million, mainly due to strong performance from both the strategic portfolio and the diversification portfolio. The share prices of Grupo Financiero Inbursa (+42.2%), Cellnex (+15.3%), Naturgy (+11.1%) and CaixaBank (+1.5%) all performed strongly.

Operating cash flow increased considerably in 2023, rising to €966 million compared to €725 million in 2022. This was due to CriteriaCaixa receiving record dividend income of €1,114 million from its investees in 2023, 33.6% up on the previous year. Noteworthy dividends were contributed by CaixaBank (€558 million), Naturgy (€388 million), Telefónica (€42 million), The Bank of East Asia (€32 million) and the diversification portfolio (€94 million).

Isidro Fainé, Chairman of CriteriaCaixa and “la Caixa” Foundation, highlighted the strength of the company’s results: “The strong performance of CriteriaCaixa’s main investees has boosted dividends. This will give “la Caixa” Foundation a budget of €600 million for social action in 2024, the largest in its history”.

The Board of Directors of CriteriaCaixa has asked the new CEO, Ángel Simón, to draw up a Strategic Plan for 2025-2030 to lay the foundations for this new phase, aiming to drive the creation of long-term value and maintain and increase the Foundation’s assets, so as to bolster its social work.

Business results

Recurring profit attributable to the banking portfolio amounted to €1,756 million in 2023, up 58% on the previous year. This improvement was largely due to the strong performance of CaixaBank and Grupo Financiero Inbursa (GFI), which contributed €1,509 million and €154 million, respectively, to the earnings of CriteriaCaixa Group.

The profit of the industrial and services portfolio amounted to €608 million, 11% higher than in 2022. Within this portfolio, Naturgy’s net profit attributable to CriteriaCaixa amounted to €530 million in 2023, 20% higher than in the previous year.

Portfolio management

CriteriaCaixa’s strategic portfolio comprises significant stakes in leading companies in which Criteria pursues active management. At 31 December 2023, this portfolio comprised CaixaBank (31.92%), Grupo Financiero Inbursa (9.10%), The Bank of East Asia (19.19%), Naturgy (26.71%), Cellnex (4.36%) and Telefónica (2.55%).

The market value of this portfolio at 31 December 2023 was €19,613 million, with returns (including dividends) of 14.3% during the year. In 2023, CriteriaCaixa invested €81 million in Telefónica, with divestments in CaixaBank of €100 million.

CriteriaCaixa also holds a diversified portfolio of companies from various geographies and sectors, prioritising listed companies from OECD countries (mainly Europe and the United States). This portfolio currently includes around 75 companies in 13 countries, the vast majority of which are large listed companies and leaders in their respective sectors, with around 64% of them being large cap (market capitalisation of more than €10 billion).

The market value of this portfolio at year-end was €2,515 million, distributed in Consumer discretionary (28%), Health (15%), Consumer non-discretionary (14%), Materials and others (13%), Technology (12%), Infrastructure and communication services (7%), Industry (6%), Energy (3%) and Others (2%).

The management strategy for this portfolio in 2023 focussed on attracting value by rotating companies. The return on this portfolio during the year was 17.1%, including dividends.

The market value of the portfolio of non-listed equities was €837 million at 31 December 2023. This portfolio includes the 99.5% stake in Saba Infraestructuras, a 15% holding in Aigües de Barcelona and venture capital activity.

The CriteriaCaixa Group’s real estate portfolio, which is managed through InmoCaixa, amounted to €2,694 million in 2023. InmoCaixa invested €90 million during the year, mainly in new residential developments (including the new phase of the up-market Infinitum resort) and office developments, including the new Visionary Building in Madrid and the purchase of an office building in Alcobendas. Sales of this portfolio amounted to €135 million in 2023, while rental income (residential and office) stood at €52 million.

Financial strength

CriteriaCaixa continued to pay down its debt in 2023, which fell to €4,433 million (a decrease of €489 million in the year). It also continued to actively manage its debt with the aim of achieving greater flexibility, maintaining comfortable liquidity levels, and extending the maturities of its debt and credit facilities.

78% of total gross debt matures in the long term. The average cost of debt was 2.7%. This was impacted by the ECB’s monetary policy to fight inflation, which led to higher interest rates throughout 2023.

CriteriaCaixa ended the year with liquidity of €988 million, including cash and undrawn committed credit facilities.

The rating agencies ratified CriteriaCaixa’s credit ratings in 2023: BBB+ (stable outlook) from Fitch Ratings and Baa2 (upgraded to positive outlook) from Moody’s.

Social dividend for “la Caixa” Foundation

In 2023, CriteriaCaixa distributed a social dividend of €400 million to its sole shareholder, “la Caixa” Foundation. During the year, the Foundation allocated €537 million to social programmes (59.1%), culture and science (21.6%), research and health (11.2%) and education and scholarships (8.1%).

The Foundation has announced a budget of €600 million for 2024. This is the largest budget in its history and is 12% higher than in 2023.

Of the total investment planned for 2024, 58.7% – over €350 million – will be allocated to social programmes, including CaixaProinfancia, which fights child poverty, the Incorpora and Reincorpora employment inclusion projects, the Comprehensive Care for People with Advanced Diseases programme, and the programme to encourage social involvement of the elderly. Around €60 million will be available for applications for aid for social projects to meet the needs of all the territories.

The Foundation’s investment in social programmes will have the largest budget increase, rising by more than 10% in 2024 to foster strategic programmes with transformative impact on major social problems. Its main lines of action will continue to include support for medical research, with the creation of the CaixaResearch Institute, culture and science, and education and training for all types of groups.

Responsible business

CriteriaCaixa is governed by the same principles of action as “la Caixa” Foundation, which are aligned with the principles of the United Nations Global Compact and the Sustainable Development Goals.

CriteriaCaixa has a universal commitment to ESG (environmental, social and corporate governance) aspects, ranging from the investment and management of its investees – monitoring their ESG performance in addition to their financial results – to the use of the funds obtained: the social dividend distributed to “la Caixa” Foundation for its social action.

For more information:

CriteriaCaixa Communication – Tel. +34 659 576 380 / +34 649 254 091 comunicacion@criteria.com

APPENDICES

CriteriaCaixa’s 2023 consolidated income statement:

Group structure at year-end 2023: