- Gross asset value (GAV) of CriteriaCaixa amounted to €26.43 billion, up by 7.5% on year-end 2022, thanks to the positive performance of the share price in its listed equities portfolio.

- Net assets value (NAV) came to €22.08 billion, 12.3% up on year-end 2022.

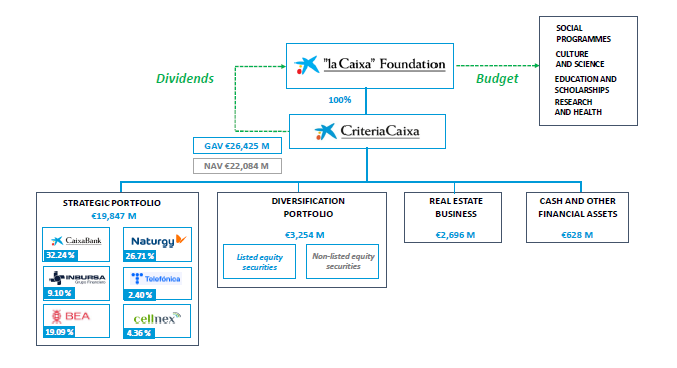

- In the first half, CriteriaCaixa distributed €210 million (social dividend) to its sole shareholder, “la Caixa” Foundation.

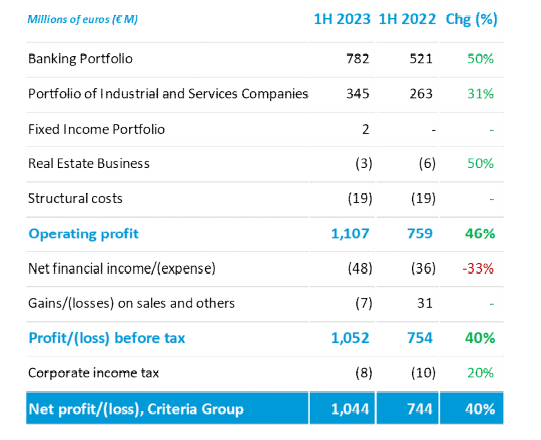

Barcelona, 31 July, 2023. CriteriaCaixa, the company managing “la Caixa” Foundation’s business assets, posted consolidated net profit of €1.04 billion during the first half of 2023, 40% up on 1H 2022, thanks to the positive results of its two main investees, CaixaBank and Naturgy.

The gross asset value (GAV) of CriteriaCaixa came to €26.43 billion during the first half of the year, up 7.5% on year-end 2022. From this, 84% corresponded to listed equities, which shows the high liquidity of its assets, and 10% to the real-estate business, among others.

Net asset value (NAV) stood at €22.08 billion, 12.3% up on year-end 2022. The improvement is mainly attributable to the strong performance of share price of Naturgy (+12.1%), Grupo Financiero Inbursa (+23.8%), CaixaBank (+3.1%) and Cellnex (+19.6%). In addition, operating cash flow strongly performed to €724 million, thanks to the increase of dividends received in the first half totalling €791 million (€564 million in the 1H 2022). Of the total dividends received in the first six months, €558 million came from CaixaBank (€354 million in the first half of 2022), €129 million from Naturgy, €20 million from Telefónica, €10 million from the Bank of East Asia and €74 million from the diversification portfolio.

During the first half of the year, CriteriaCaixa distributed €210 million (social dividend) to its sole shareholder, “la Caixa” Foundation, whose budget for social action comes to €538 million in 2023, allocated to social programmes (59.4%), culture and science (20.9%), research and health (11.5%) and education and scholarships (8.2%).

Portfolio management

CriteriaCaixa’s strategic portfolio is made of the stakes in CaixaBank (32.24%), Naturgy (26.71%), Grupo Financiero Inbursa (9.10%), The Bank of East Asia (19.09%), Cellnex (4.36%) and Telefónica (2.40%). Its market value at June 30 2023 amounts to €19,847 million, with a positive evolution compared to the end of 2022 (€18,088 million). During the first half of the year, €48 million were invested in this portfolio, specifically in Telefónica.

In the other hand, CriteriaCaixa also maintains a diversified portfolio comprising non-controlling stakes in listed companies, prioritising companies from OECD countries (mainly European and USA). This portfolio is made up of approximately 80 companies from 13 different countries, of which the vast majority large are large companies leader in their industries.

During the first half of 2023, the management strategy for this portfolio focused on attracting value by rotating companies. The market value of the portfolio at 30 June 2023 amounted to €2.41 billion, mainly in the following sectors: Consumer discretionary (22%), Health (17%), Consumer non-discretionary (14%), Technology (12%), and Materials (8%), among others.

CriteriaCaixa’s real estate portfolio was worth €2.7 billion in the period. In the first half of the year, Infinitum Resort has completed the commercialization of the first phase of 150 apartments and has started the construction and commercialization of a second phase of 119 homes. In the office rental business, the first building developed by InmoCaixa, the Visionary building in Madrid, was completed and put into operation.

Also, following major changes in the monetary policy of the main central banks, CriteriaCaixa increased its exposure to listed fixed-income securities during the first half, with a portfolio with a market value of €124 million, as a result of the investment of €43 million in it.

Financial profile

By the end of the first half, Criteria Group’s gross debt fell to €4.34 billion, from €4.92 billion at 31 December 2022, following the redemption of a €750 million senior bond issue (of which €37 million were held in treasury stock) which matured in May. CriteriaCaixa continued to actively manage its funding sources, with the signature of new bilateral loans totalling €245 million during the first six months.

CriteriaCaixa maintains comfortable liquidity levels at €777 million at 30 June, which includes both cash and equivalents and undrawn committed credit facilities.

Rating agencies ratified CriteriaCaixa’s credit rating: BBB+ by Fitch Ratings (stable outlook) and Baa2 by Moody’s (improving outlook from stable to positive) throughout the first half of the year.

APPENDICES

CriteriaCaixa’s consolidated income statement – 1H 2023:

Group Structure – 1H 2023: